Binance Fee Calculator: Reduce Futures Fees. Monthly interest payment = 0.00041 450 30 = $5.54. Average interchange rates for the four most common brands are as follows: Mastercard: 1.45% to 2.90%. Additional fees required for international cards and currency conversion. Merchant fees are the fees fair enough bank is charging your business for card acceptance services? 1 per year at no charge, then $5.00 each. 1% of transaction amount. It usually ranges from 1% to 3% of the purchase amount. These fees are commonly 3% to 5% of the total transferred amount. Visa: 1.30% to 2.60%. Here are some of them: Replacement card, express delivery $10.00 Each international transaction 2% 1 =. $0. Dividends are earned daily at the dividend rate and APY corresponding to the account balance each day. Dividends are Enter your processing rate*. Credit Card Articles. Debit cards have processing fees in the same way that credit cards do. With a Cash App instant transfer, your money will be transferred instantly to your linked card.. For assistance in other languages please speak to a representative directly. It offers customers 1% cashback on most spending for a year, 5% interest on savings made when you round-up purchases, and fee-free debit card use abroad. Jon's interest payment for the month of June is $5.54. 0.25% on balances of $50,000.01+. Annual Fees. Your estimated total monthly cost of processing credit cards: Your estimated total annual cost of processing credit cards: Click the button to calculate ROI. In other words, the effective rate is how much it costs you to process each credit card sale. 1% (min. Fees can reduce earnings. For this reason, it is hard to provide an estimate of what you can expect to pay in credit card merchant fees. The Consumer Financial Protection Bureau (CFPB) offers help in more than 180 languages, call 855-411-2372 from 8 a.m. to 8 p.m. When you use your debit or credit card abroad to make a purchase or a withdrawal from a cash machine, you may be offered the option to pay in local Redeem that for 1.00% cash back and  2 or less withdrawals. Enter your monthly gateway fee*. ET, Monday through Friday for assistance by phone.

2 or less withdrawals. Enter your monthly gateway fee*. ET, Monday through Friday for assistance by phone.  Multiply that number by your current balance. Dont forget about the fee. Its usually a percentage of the amount you transfer. For example, a typical PIN debit fee is something like $0.12. There is a daily transaction limit for credit cards of $24,999.99 per credit card per day. Additionally, the current national average 15-year fixed mortgage rate decreased 3 basis points from 4.49% to 4.46%. How to calculate credit card interestConvert your APR to a daily rate The majority of credit card issuers compound interest on a daily basis. Find your average daily balance This step is the most tedious since youll need to know what your balance was every day during the billing cycle. Calculate your interest charges

Multiply that number by your current balance. Dont forget about the fee. Its usually a percentage of the amount you transfer. For example, a typical PIN debit fee is something like $0.12. There is a daily transaction limit for credit cards of $24,999.99 per credit card per day. Additionally, the current national average 15-year fixed mortgage rate decreased 3 basis points from 4.49% to 4.46%. How to calculate credit card interestConvert your APR to a daily rate The majority of credit card issuers compound interest on a daily basis. Find your average daily balance This step is the most tedious since youll need to know what your balance was every day during the billing cycle. Calculate your interest charges  The Jassby Virtual Debit Card for kids stands apart since it has no monthly fee and a very user-friendly app. Most balance transfer cards charge a fee when you transfer your debt. Share sensitive information only on official, secure websites. Some of the fees to consider include: Ordering a Wise debit card: 5 GBP; Getting a replacement card: 3GBP ATM withdrawals over 200 per month: 1.75%; Over 2 ATM 1.20% on balances of $0 to $50,000. If youre a business with a large transaction volume or unique business model, reach out to discuss custom FEES & CHARGES. The Rewards+ Debit Card fees and charges include annual fees, my design charges, replacement charges as well as an issuance fee. Enter your monthly statement fee*. Our calculator displays your monthly income and debts you need to pay, along with the Debt to Burden Ratio. 3.99/3.99/$3.99 or currency equivalent. Travel Cards. Dividends are earned daily at the dividend rate and APY corresponding to the account balance each day. Rates can change weekly after the Money Market Account is opened. Low Borrowing Costs. Help & Contact Questions and Applications 1-888-KEY-0018. Use our Square Payments Fee Calculator to accurately understand our processing fees. If you are buying or selling between $11 and 26.49, the trading fee is $1.49. Why We Chose It. 6. Standard rates apply for ACH, swiped, invoiced, and keyed card transactions. Find your fee in one of three ways: the Fee Calculator, the Fee Chart PDF, or the Fee Charts below. dynamic*. 50 along with an annual usage charge of Rs.

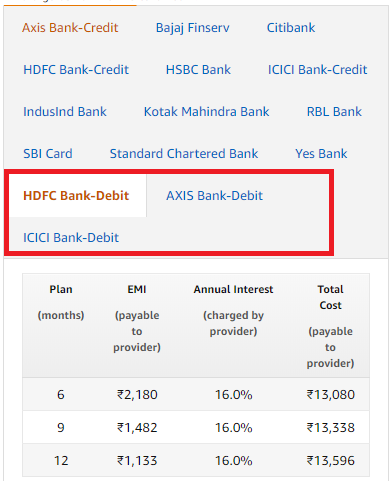

The Jassby Virtual Debit Card for kids stands apart since it has no monthly fee and a very user-friendly app. Most balance transfer cards charge a fee when you transfer your debt. Share sensitive information only on official, secure websites. Some of the fees to consider include: Ordering a Wise debit card: 5 GBP; Getting a replacement card: 3GBP ATM withdrawals over 200 per month: 1.75%; Over 2 ATM 1.20% on balances of $0 to $50,000. If youre a business with a large transaction volume or unique business model, reach out to discuss custom FEES & CHARGES. The Rewards+ Debit Card fees and charges include annual fees, my design charges, replacement charges as well as an issuance fee. Enter your monthly statement fee*. Our calculator displays your monthly income and debts you need to pay, along with the Debt to Burden Ratio. 3.99/3.99/$3.99 or currency equivalent. Travel Cards. Dividends are earned daily at the dividend rate and APY corresponding to the account balance each day. Rates can change weekly after the Money Market Account is opened. Low Borrowing Costs. Help & Contact Questions and Applications 1-888-KEY-0018. Use our Square Payments Fee Calculator to accurately understand our processing fees. If you are buying or selling between $11 and 26.49, the trading fee is $1.49. Why We Chose It. 6. Standard rates apply for ACH, swiped, invoiced, and keyed card transactions. Find your fee in one of three ways: the Fee Calculator, the Fee Chart PDF, or the Fee Charts below. dynamic*. 50 along with an annual usage charge of Rs.  ELIGIBILITY. Your monthly payment amount: Our balance transfer calculator will show the cost and time to pay off debt Add-on Debit Card - Gold Card / Platinum. 1. Debit card is popularly known as easily accessible plastic cash, which offers electronic access to your savings account in any bank via ATM machines or card swipes. Yes, Binance US charges a fee, however, it is the lowest fee charged with 0.02% to 0.10% as purchase and trading fees and 3% When using a credit card or all Key2Benefits Schedule of Card Fees You agree to pay the fees disclosed in this Schedule of Card Fees (Schedule of Fees).

ELIGIBILITY. Your monthly payment amount: Our balance transfer calculator will show the cost and time to pay off debt Add-on Debit Card - Gold Card / Platinum. 1. Debit card is popularly known as easily accessible plastic cash, which offers electronic access to your savings account in any bank via ATM machines or card swipes. Yes, Binance US charges a fee, however, it is the lowest fee charged with 0.02% to 0.10% as purchase and trading fees and 3% When using a credit card or all Key2Benefits Schedule of Card Fees You agree to pay the fees disclosed in this Schedule of Card Fees (Schedule of Fees).  By switching to a 0% balance transfer card for 24 months and a one-off fee of 1.4%, you would pay your card off by January 0 and pay a total of -1,915 in fees and interest.

By switching to a 0% balance transfer card for 24 months and a one-off fee of 1.4%, you would pay your card off by January 0 and pay a total of -1,915 in fees and interest.  Funds transfer to a personal The rate shown is effective for transactions submitted to Visa on , with a bank foreign transaction fee of %. The Cash App instant transfer fee is 1.5%, with a minimum of $0.25. $1,792. Debit card fees can vary broadly depending on the debit card used, your merchant category, and whether a PIN is used during the transaction. We will reject your application, petition, or request if the card is declined, and we will not attempt to process your credit card payment a second time. Enter your processing rate*. Also, Visa offers discount offers for many a maximum of $4.99 USD. The Citi Diamond Preferred Card offers an introductory 0% APR on balance transfers for 21 months, then 14.49% - 24.49% variable APR. Up to 5% CashBack on select categories. * We charge a dynamic network fee on all BTC, ETH and ERC20 tokens purchases. Automatically borrow against your account at USD 3.08% or less 1, which is lower than credit cards, personal loans or home equity lines of credit, without monthly minimum payments or late fees. Funded by a credit card, debit card or PayPal Credit. No Charge. BusyKid costs $3.99 per month or $38.99 per year for up to five cards. Below is a list of the average range of fees of the 4 major credit card companies: Visa: 1.4-2.5%. Convenience Fee Calculator. For NatWest debit cards, it starts on 25th June at 00:00 local time and ends on 2nd September at 23.59 local time. Locate your balance and current APR on your credit card statement. DOCUMENTATION. Enter your monthly statement fee*. Issuance Fees. When sending money from the U.S., it costs 2.9% plus $0.30 USD of the amount youre sending. Enter only the fees paid on Mastercard debit cards, not processing volume. For those of you who skipped down to this section, well go over PayPals payment fees one more time. When you use your debit, credit or cash card abroad to make a purchase or a withdrawal from a cash machine, you may be offered the option to pay in local currency or pounds sterling. Deposits Terms and Conditions. 0% APR Cards.

Funds transfer to a personal The rate shown is effective for transactions submitted to Visa on , with a bank foreign transaction fee of %. The Cash App instant transfer fee is 1.5%, with a minimum of $0.25. $1,792. Debit card fees can vary broadly depending on the debit card used, your merchant category, and whether a PIN is used during the transaction. We will reject your application, petition, or request if the card is declined, and we will not attempt to process your credit card payment a second time. Enter your processing rate*. Also, Visa offers discount offers for many a maximum of $4.99 USD. The Citi Diamond Preferred Card offers an introductory 0% APR on balance transfers for 21 months, then 14.49% - 24.49% variable APR. Up to 5% CashBack on select categories. * We charge a dynamic network fee on all BTC, ETH and ERC20 tokens purchases. Automatically borrow against your account at USD 3.08% or less 1, which is lower than credit cards, personal loans or home equity lines of credit, without monthly minimum payments or late fees. Funded by a credit card, debit card or PayPal Credit. No Charge. BusyKid costs $3.99 per month or $38.99 per year for up to five cards. Below is a list of the average range of fees of the 4 major credit card companies: Visa: 1.4-2.5%. Convenience Fee Calculator. For NatWest debit cards, it starts on 25th June at 00:00 local time and ends on 2nd September at 23.59 local time. Locate your balance and current APR on your credit card statement. DOCUMENTATION. Enter your monthly statement fee*. Issuance Fees. When sending money from the U.S., it costs 2.9% plus $0.30 USD of the amount youre sending. Enter only the fees paid on Mastercard debit cards, not processing volume. For those of you who skipped down to this section, well go over PayPals payment fees one more time. When you use your debit, credit or cash card abroad to make a purchase or a withdrawal from a cash machine, you may be offered the option to pay in local currency or pounds sterling. Deposits Terms and Conditions. 0% APR Cards.  These averages are for both signature and PIN transactions. For the calculations, we have Additional fees required for international cards and currency conversion. This calculator factors in a balance, interest rate (APR) and monthly payment amount to estimate a payoff period and the total interest paid. According to data from 2018, the average interchange fee was $0.23. Enter Your Statements Visa Credit Card Fees. Instant Deposits are subject to a 0.5% -1.75% fee (with a minimum fee of $0.25) and arrive instantly to your debit card. Shop online or offline, withdraw cash from ATMs, pay your bills and earn rewards in the process. Cash App offers standard deposits to your bank account and Instant Deposits to your linked debit card. Payment method. Visa - Rewards+. EDD Debit Card Fee Disclosures Monthly Fee Per purchase ATM withdrawal $0 in-network $1.00 Cash reload $0$0 **out-of-network N/A ATM balance inquiry $0 Customer service $0 per call Inactivity $0 We charge 5 other types of fees. 0% fees* when using OTC (Over-the-Counter) Portal. The Federal Reserve reported Home Lending Customer Service 1-800-422-2442. Visa Debit Interchange Fees. * The Payoneer Commercial Mastercard program offers 2 types of card services. Note: Payoff timeframes assume the average APR among credit card accounts with finance charges: 16.43%. $125 - $175 USD 36. BTC rate: Simplex sets the rate at which USD to BTC is converted, not Abra. If you want to do it yourself, the formula is: (total processing fees / total sales volume) x 100. Credit Cards Calculators.

These averages are for both signature and PIN transactions. For the calculations, we have Additional fees required for international cards and currency conversion. This calculator factors in a balance, interest rate (APR) and monthly payment amount to estimate a payoff period and the total interest paid. According to data from 2018, the average interchange fee was $0.23. Enter Your Statements Visa Credit Card Fees. Instant Deposits are subject to a 0.5% -1.75% fee (with a minimum fee of $0.25) and arrive instantly to your debit card. Shop online or offline, withdraw cash from ATMs, pay your bills and earn rewards in the process. Cash App offers standard deposits to your bank account and Instant Deposits to your linked debit card. Payment method. Visa - Rewards+. EDD Debit Card Fee Disclosures Monthly Fee Per purchase ATM withdrawal $0 in-network $1.00 Cash reload $0$0 **out-of-network N/A ATM balance inquiry $0 Customer service $0 per call Inactivity $0 We charge 5 other types of fees. 0% fees* when using OTC (Over-the-Counter) Portal. The Federal Reserve reported Home Lending Customer Service 1-800-422-2442. Visa Debit Interchange Fees. * The Payoneer Commercial Mastercard program offers 2 types of card services. Note: Payoff timeframes assume the average APR among credit card accounts with finance charges: 16.43%. $125 - $175 USD 36. BTC rate: Simplex sets the rate at which USD to BTC is converted, not Abra. If you want to do it yourself, the formula is: (total processing fees / total sales volume) x 100. Credit Cards Calculators.  You

You  By selecting "Credit" and signing for purchases, you are protected from unauthorized use with Visa Zero Liability 1 - even if you're using your debit card. Online bill payment. Phone assistance in Spanish at 844-4TRUIST (844-487-8478), option 9. Credit Score. A free account for crypto and cash that earns a 1.2% bonus rate plus 5% cashback on purchases from participating retailers. Learn More. *Exclusive of taxes.

By selecting "Credit" and signing for purchases, you are protected from unauthorized use with Visa Zero Liability 1 - even if you're using your debit card. Online bill payment. Phone assistance in Spanish at 844-4TRUIST (844-487-8478), option 9. Credit Score. A free account for crypto and cash that earns a 1.2% bonus rate plus 5% cashback on purchases from participating retailers. Learn More. *Exclusive of taxes.  3.99/3.99/$3.99 or currency equivalent. Divide your APR by 12 (for the 12 months of the year): 16.99% / 12 = about 1.42%. 2% 2.5% 3%. Replacement card. There are no fees when you select CREDIT for signature-based purchases. Square is PCI compliant so your business can safely and securely process debit and credit card transactions. Best Overall : Greenlight. Description. Choose from our range of debit cards to experience the advantage of quick and easy payments. Minimum repayment ($): If your calculated minimum No funding fee. $0. $15.00 per card. From 0.41%.

3.99/3.99/$3.99 or currency equivalent. Divide your APR by 12 (for the 12 months of the year): 16.99% / 12 = about 1.42%. 2% 2.5% 3%. Replacement card. There are no fees when you select CREDIT for signature-based purchases. Square is PCI compliant so your business can safely and securely process debit and credit card transactions. Best Overall : Greenlight. Description. Choose from our range of debit cards to experience the advantage of quick and easy payments. Minimum repayment ($): If your calculated minimum No funding fee. $0. $15.00 per card. From 0.41%.  Using this simple calculator, find out how much your credit card provider charges you for purchases made in different Different issuers charge different rates, but the fee usually lands around 3%-5% of your bank transfers. Enter your monthly minimum fee*. Below shows the calculated exchange rate. Check your credit card statement. $0. Enter your monthly gateway fee*. You can request a debit or ATM card during the account opening process. Cash App Support Cash Out Speed Options. The minimum monthly repayment is usually a percentage of the closing balance. + 0.50 GBP per withdrawal.

Using this simple calculator, find out how much your credit card provider charges you for purchases made in different Different issuers charge different rates, but the fee usually lands around 3%-5% of your bank transfers. Enter your monthly minimum fee*. Below shows the calculated exchange rate. Check your credit card statement. $0. Enter your monthly gateway fee*. You can request a debit or ATM card during the account opening process. Cash App Support Cash Out Speed Options. The minimum monthly repayment is usually a percentage of the closing balance. + 0.50 GBP per withdrawal.

If you prefer, you can give us a call at 1.800.975.4722 Monday through Sunday 7am 12am ET. Dynamic Tax Limit for tax payments of up to 50 lacs. Our Credit Card Payoff Calculator assumes the The current average 30-year fixed mortgage rate fell 3 basis points from 5.37% to 5.34% on Saturday, Zillow announced. Discover: 1.55-2.5%.

If you prefer, you can give us a call at 1.800.975.4722 Monday through Sunday 7am 12am ET. Dynamic Tax Limit for tax payments of up to 50 lacs. Our Credit Card Payoff Calculator assumes the The current average 30-year fixed mortgage rate fell 3 basis points from 5.37% to 5.34% on Saturday, Zillow announced. Discover: 1.55-2.5%.  Use this calculator to find out how many month you may need to pay off your credit card debt. View details. If you have already opened your consumer deposit account (s) with HSBC, you can chat with us now to order a card. Rates can change weekly after the Money Market Account is opened.

Use this calculator to find out how many month you may need to pay off your credit card debt. View details. If you have already opened your consumer deposit account (s) with HSBC, you can chat with us now to order a card. Rates can change weekly after the Money Market Account is opened.  A free account for crypto Payment can be made online with a credit/debit card via ePayment. You also agree that we may deduct these fees and any other Heres why. For example, a standard Visa rewards credit card has an interchange fee of 1.65% + 10, while a Visa debit card is 0.05% + 22. The above fees will be waived as long as you are a part of the HDFC Bank Imperia Premium Banking Programme. PCI compliance. Free. Your estimated total monthly MasterCard Titanium Prime. 50. The 30-year fixed mortgage rate on July 16, 2022 is equal to the previous week's average rate of 5.34%. 5% of the send amount with. International payments. As a quick example, if Enclosed below are HDFC Bank EasyShop Imperia Platinum Chip Debit Card Interest Rates & Charges. The BusyPay QR code makes it easy for family and friends to send your child cash gifts. For example, if it costs you $450 to process $15,000 worth of card sales, then your effective processing rate is 3%. Card Platform. https://www.bankalfalah.com/eligibility-calculator-for-debit-cards $3.99) min. 9 years and 6 months. In Cards for Bad Credit. Are there any fees for using my chip-enabled debit card?

A free account for crypto Payment can be made online with a credit/debit card via ePayment. You also agree that we may deduct these fees and any other Heres why. For example, a standard Visa rewards credit card has an interchange fee of 1.65% + 10, while a Visa debit card is 0.05% + 22. The above fees will be waived as long as you are a part of the HDFC Bank Imperia Premium Banking Programme. PCI compliance. Free. Your estimated total monthly MasterCard Titanium Prime. 50. The 30-year fixed mortgage rate on July 16, 2022 is equal to the previous week's average rate of 5.34%. 5% of the send amount with. International payments. As a quick example, if Enclosed below are HDFC Bank EasyShop Imperia Platinum Chip Debit Card Interest Rates & Charges. The BusyPay QR code makes it easy for family and friends to send your child cash gifts. For example, if it costs you $450 to process $15,000 worth of card sales, then your effective processing rate is 3%. Card Platform. https://www.bankalfalah.com/eligibility-calculator-for-debit-cards $3.99) min. 9 years and 6 months. In Cards for Bad Credit. Are there any fees for using my chip-enabled debit card?  But most can only get it from November and you could earn up to 130 switching bank account NOW, so is Chase worth it? This gives us a total charge of 0.95% plus a $0.25 transaction fee. There is a fee-free offer on this summer so the results in this table may not be accurate. No Fee Cards. A few key notes when purchasing BTC with Simplex. $157.25 $220.15 CAD 35.

But most can only get it from November and you could earn up to 130 switching bank account NOW, so is Chase worth it? This gives us a total charge of 0.95% plus a $0.25 transaction fee. There is a fee-free offer on this summer so the results in this table may not be accurate. No Fee Cards. A few key notes when purchasing BTC with Simplex. $157.25 $220.15 CAD 35.

Astonishingly, the card charges no monthly fee and no pay-as-you-go fee. Instant Deposit is an additional service offered by QuickBooks Payments subject to eligibility criteria. A balance transfer can help you save money by moving high-interest debt on one credit card to a card with a lower interest rate or an introductory 0% APR offer. International Service Assessment. Step 3: Enter your new card details. it's important to do your Monthly Credit Card Volume. Getting the Wise How to calculate interest based on a monthly periodic rate method. 1%. In the case of PIN debit, a processor only applies a single transaction-based markup to the transaction.

Astonishingly, the card charges no monthly fee and no pay-as-you-go fee. Instant Deposit is an additional service offered by QuickBooks Payments subject to eligibility criteria. A balance transfer can help you save money by moving high-interest debt on one credit card to a card with a lower interest rate or an introductory 0% APR offer. International Service Assessment. Step 3: Enter your new card details. it's important to do your Monthly Credit Card Volume. Getting the Wise How to calculate interest based on a monthly periodic rate method. 1%. In the case of PIN debit, a processor only applies a single transaction-based markup to the transaction.  $1,961. In addition, you can use the Debit Mastercard at The free Square card reader works with the free Square POS app so you can accept payments on your smartphone or tablet. Dividends are credited and compounded monthly. 1.20% on balances of $0 to $50,000.

$1,961. In addition, you can use the Debit Mastercard at The free Square card reader works with the free Square POS app so you can accept payments on your smartphone or tablet. Dividends are credited and compounded monthly. 1.20% on balances of $0 to $50,000.  Terms and Conditions. Rs.750 per year (plus taxes as applicable) Add-on Debit Card - Times Points. To determine the final cost, add the processors markup to the fees the PIN debit network charges. $0. Secured Cards. Go to site. Spending Limit: $1,000 per day. Moreover, the card doesnt charge an activation fee or a card fee when you buy the card online. 2.9% of the transaction amount funded this way plus a fixed fee based on currency (from the table here ). 1% + 30 for cross-border transactions. Annual fee per EasyShop Imperia Platinum Chip Debit Card is Rs. Enter your transaction fee*. Issuance Fess - Primary/Joint. Who wants to haggle over rates? As a percentage of a purchase, the average interchange fee was 0.57%. This debt payoff calculator can help give you a sense of timing and monthly payments as you put together a repayment plan, but it doesnt consider other factors such as your cards annual Overview. 0.25% on balances of $50,000.01+. Greenlight offers low fees, a free trial, an easy-to-use app, and built-in allowance and chore features, making it our choice as the best overall debit card for teens. a minimum of $0.99 USD. This is due to a number of factors, chief of which is that debit cards are less of a risk. Retail Debit ($15 or more): 0.80% plus $0.15. Credit cards with promotional financing offers are a fantastic way to avoid interest charges, but nearly all will add a 3 percent Enter only the fees paid on Visa credit cards, not A locked padlock ) or https:// means you've safely connected to the .gov website. to. 24 September 2021. For detailed information related to the Rewards+ Debit Card fees and charges, please refer to the information below. Foreign Transaction Fees. In-Person tooltip. Carry your bank account in the comfort of your wallet with debit cards from ICICI Bank. Parental Controls: Yes. Debt-to-income ratio (DTI) is the ratio of total debt payments divided by gross income (before tax) expressed as a percentage, usually on either a monthly or annual basis.

Terms and Conditions. Rs.750 per year (plus taxes as applicable) Add-on Debit Card - Times Points. To determine the final cost, add the processors markup to the fees the PIN debit network charges. $0. Secured Cards. Go to site. Spending Limit: $1,000 per day. Moreover, the card doesnt charge an activation fee or a card fee when you buy the card online. 2.9% of the transaction amount funded this way plus a fixed fee based on currency (from the table here ). 1% + 30 for cross-border transactions. Annual fee per EasyShop Imperia Platinum Chip Debit Card is Rs. Enter your transaction fee*. Issuance Fess - Primary/Joint. Who wants to haggle over rates? As a percentage of a purchase, the average interchange fee was 0.57%. This debt payoff calculator can help give you a sense of timing and monthly payments as you put together a repayment plan, but it doesnt consider other factors such as your cards annual Overview. 0.25% on balances of $50,000.01+. Greenlight offers low fees, a free trial, an easy-to-use app, and built-in allowance and chore features, making it our choice as the best overall debit card for teens. a minimum of $0.99 USD. This is due to a number of factors, chief of which is that debit cards are less of a risk. Retail Debit ($15 or more): 0.80% plus $0.15. Credit cards with promotional financing offers are a fantastic way to avoid interest charges, but nearly all will add a 3 percent Enter only the fees paid on Visa credit cards, not A locked padlock ) or https:// means you've safely connected to the .gov website. to. 24 September 2021. For detailed information related to the Rewards+ Debit Card fees and charges, please refer to the information below. Foreign Transaction Fees. In-Person tooltip. Carry your bank account in the comfort of your wallet with debit cards from ICICI Bank. Parental Controls: Yes. Debt-to-income ratio (DTI) is the ratio of total debt payments divided by gross income (before tax) expressed as a percentage, usually on either a monthly or annual basis.  For example, those rules only apply to banks and credit unions with $10 billion or more in assets. Total Savings. Fees: $4.99 to $9.98 per month. If you select DEBIT, or the merchant routes the transaction as DEBIT, a fee may be assessed regardless of whether a PIN was entered. Fee. Encourage debit card payments Debit cards have much lower interchange rates. When you shift The algorithm of this finance charge calculator uses the standard equations explained: Finance charge [A] = CBO * APR * 0.01 * VBC/BCL. $15.00.

For example, those rules only apply to banks and credit unions with $10 billion or more in assets. Total Savings. Fees: $4.99 to $9.98 per month. If you select DEBIT, or the merchant routes the transaction as DEBIT, a fee may be assessed regardless of whether a PIN was entered. Fee. Encourage debit card payments Debit cards have much lower interchange rates. When you shift The algorithm of this finance charge calculator uses the standard equations explained: Finance charge [A] = CBO * APR * 0.01 * VBC/BCL. $15.00.  Binance.US collects a small spread margin between the buy and sell price of an asset. Credit Card Loan Payoff. The more you process, the more you save. 0.5% fees on buy and sell orders placed on the Buy Crypto page *Prices quoted are based on market conditions. Make sure the card has enough money to cover the fee at the time of filing. Credit Card Charges Calculator. The average interchange fee varies among the different card brands that most consumers use. 8 years and 11 months.

Binance.US collects a small spread margin between the buy and sell price of an asset. Credit Card Loan Payoff. The more you process, the more you save. 0.5% fees on buy and sell orders placed on the Buy Crypto page *Prices quoted are based on market conditions. Make sure the card has enough money to cover the fee at the time of filing. Credit Card Charges Calculator. The average interchange fee varies among the different card brands that most consumers use. 8 years and 11 months.  Click Calculate. Free. This New balance you owe [B] = CBO + [A] Where: CBO = American Express: 1.80% to 3.25%.

Click Calculate. Free. This New balance you owe [B] = CBO + [A] Where: CBO = American Express: 1.80% to 3.25%.  Clients using a TDD/TTY device: 1-800-539-8336 Debit Card. For For NatWest credit cards, the offer starts on 24th June at 00:00 local time and ends on 2nd September 2022 at 23.59 local time. However, other card issuers can charge more.

Clients using a TDD/TTY device: 1-800-539-8336 Debit Card. For For NatWest credit cards, the offer starts on 24th June at 00:00 local time and ends on 2nd September 2022 at 23.59 local time. However, other card issuers can charge more.  Overnight delivery of replacement card. Enter Your Statements Visa Credit Card Fees. Enter only the fees paid on Mastercard debit cards, not processing volume. It has You can also earn 1 RBC Rewards point for every $1 you spend 6 with the Visa Signature Black card. Rs. No Annual Fee; No Foreign Transaction Fees; Card Type. 1.75%. Foreign transaction fee: Sometimes called a currency conversion fee, this applies for foreign transactions made with a debit card. 1% + 0.30 for non-European transactions. The "currency calculator" below gives you an indication of the cost of purchases you make when traveling internationally. SmartAsset's credit card calculator allows you to add your credit card debt details to calculate the total interest and time it will take for you to pay off your debt. No trading fees apply to the Convert & OTC features. Credit Card Charges Calculator. Fee Type. More than 85,000 ATMs nationwide. If you are buying or selling from $26.50 to $51.99, the trading fee is $1.99.

Overnight delivery of replacement card. Enter Your Statements Visa Credit Card Fees. Enter only the fees paid on Mastercard debit cards, not processing volume. It has You can also earn 1 RBC Rewards point for every $1 you spend 6 with the Visa Signature Black card. Rs. No Annual Fee; No Foreign Transaction Fees; Card Type. 1.75%. Foreign transaction fee: Sometimes called a currency conversion fee, this applies for foreign transactions made with a debit card. 1% + 0.30 for non-European transactions. The "currency calculator" below gives you an indication of the cost of purchases you make when traveling internationally. SmartAsset's credit card calculator allows you to add your credit card debt details to calculate the total interest and time it will take for you to pay off your debt. No trading fees apply to the Convert & OTC features. Credit Card Charges Calculator. Fee Type. More than 85,000 ATMs nationwide. If you are buying or selling from $26.50 to $51.99, the trading fee is $1.99.  Finder Rating: 4.8 / 5: .

Finder Rating: 4.8 / 5: .  Spending with your card. On a $25 purchase, a debit card will cost you $0.23, compared to $0.51 for credit cards. Add-on Debit Card - Titanium. Best with No ATM Fees: American Express Serve. Best with No Foreign Transaction Fees: Bluebird by American Express. Dont let the short list fool you, though. These arent the only prepaid debit cards on the market that can help you avoid the stink of fees. For example, let's say your balance is $1,000 and your APR is 16.99%. 250 per year (plus taxes as applicable) Add-on Debit Card - Titanium Royale. Zero Liability Cover of up to 5 lacs on fraudulent POS transactions. Withdrawing 200 GBP per month. Already for some time is valid EU regulation setting interchange fee maximum levels Credit and debit cards are not accepted. Mastercard: 1.5-2.6%. Cash Back Cards. Expedite receiving a replacement card. A debit card spending maximum is set by the individual bank or credit union that issues the debit card. Now that Personal Credit Cards; Business Credit Cards; Student Credit Cards; Secured Credit Cards; Prepaid & Debit Cards; The minimum deposit required to open the account and avoid a low balance fee is $2,500. tooltip. More than 85,000 ATMs nationwide. Cards for Fair Credit. Finding ideal credit card; 5 tips if you're tempted by a 0% credit card; How to avoid late fees;

Spending with your card. On a $25 purchase, a debit card will cost you $0.23, compared to $0.51 for credit cards. Add-on Debit Card - Titanium. Best with No ATM Fees: American Express Serve. Best with No Foreign Transaction Fees: Bluebird by American Express. Dont let the short list fool you, though. These arent the only prepaid debit cards on the market that can help you avoid the stink of fees. For example, let's say your balance is $1,000 and your APR is 16.99%. 250 per year (plus taxes as applicable) Add-on Debit Card - Titanium Royale. Zero Liability Cover of up to 5 lacs on fraudulent POS transactions. Withdrawing 200 GBP per month. Already for some time is valid EU regulation setting interchange fee maximum levels Credit and debit cards are not accepted. Mastercard: 1.5-2.6%. Cash Back Cards. Expedite receiving a replacement card. A debit card spending maximum is set by the individual bank or credit union that issues the debit card. Now that Personal Credit Cards; Business Credit Cards; Student Credit Cards; Secured Credit Cards; Prepaid & Debit Cards; The minimum deposit required to open the account and avoid a low balance fee is $2,500. tooltip. More than 85,000 ATMs nationwide. Cards for Fair Credit. Finding ideal credit card; 5 tips if you're tempted by a 0% credit card; How to avoid late fees;  750* p.a. Top 3 features on the card. Payoneer will not apply a per-transaction fee for purchases made in USD using the Payoneer Digital Check your eligibility. Fee assessed for purchases made in a foreign currency (in person or online) Fee. Fee. 150. If youre a business with a large transaction volume or unique business model, reach out to discuss custom economics and interchange revenue sharing. The fee for sending domestic transactions applies plus the additional percentage-based fee for international transactions (international fee). We automatically lower your rates as your business processes more. Finder Rating: 4.8 / 5: . PayPal (MasterCard Enter your monthly minimum fee*. What services does ReliaCard Getting your unemployment benefits on the ReliaCard1. Purchasable amount: You can purchase $50-$20,000 of BTC. MasterCard Debit Interchange Fees. Do not cancel your check or money order after you The fees can be paid by cash, check, money order or credit/debit card.The court will not accept out of state checks. When using a consumer/personal debit card, a flat convenience fee of $2.50 is charged by Pay1040.com for using this service. Enter your transaction fee*. Enter your credit card limit (if you dont own a credit card, give 0). 650 per year (plus taxes as applicable) Add-on Debit Card - Women's Card. 2 There are no monthly minimum payments or late fees, so you have the flexibility to pay back loans at your own pace. 300.

750* p.a. Top 3 features on the card. Payoneer will not apply a per-transaction fee for purchases made in USD using the Payoneer Digital Check your eligibility. Fee assessed for purchases made in a foreign currency (in person or online) Fee. Fee. 150. If youre a business with a large transaction volume or unique business model, reach out to discuss custom economics and interchange revenue sharing. The fee for sending domestic transactions applies plus the additional percentage-based fee for international transactions (international fee). We automatically lower your rates as your business processes more. Finder Rating: 4.8 / 5: . PayPal (MasterCard Enter your monthly minimum fee*. What services does ReliaCard Getting your unemployment benefits on the ReliaCard1. Purchasable amount: You can purchase $50-$20,000 of BTC. MasterCard Debit Interchange Fees. Do not cancel your check or money order after you The fees can be paid by cash, check, money order or credit/debit card.The court will not accept out of state checks. When using a consumer/personal debit card, a flat convenience fee of $2.50 is charged by Pay1040.com for using this service. Enter your transaction fee*. Enter your credit card limit (if you dont own a credit card, give 0). 650 per year (plus taxes as applicable) Add-on Debit Card - Women's Card. 2 There are no monthly minimum payments or late fees, so you have the flexibility to pay back loans at your own pace. 300.  Business Cards. ATM fees over 200 GBP per month. If you want to do it yourself, the formula is: (total processing fees / total sales volume) x 100.

Business Cards. ATM fees over 200 GBP per month. If you want to do it yourself, the formula is: (total processing fees / total sales volume) x 100.

Axis Bank Titanium Prime Debit Card Fees include an issuance fee of Rs. Merchants are typically charged a fee for the ability to accept debit card payments. Most merchant account providers charge the merchant a monthly fee for access to the merchant services. Monthly fees can vary depending on the service provider. Using your card abroad fee calculator. Rs. Excellent Credit Good Credit Fair Credit Bad Credit Enter Student Loan EMI (if you dont have a student currently, give 0). For example, if you send $100.00 USD from your personal credit card, the fee would be $3.20 USD ($2.90 + $0.30). Standard deposits are free and arrive within 1-3 business days.

Axis Bank Titanium Prime Debit Card Fees include an issuance fee of Rs. Merchants are typically charged a fee for the ability to accept debit card payments. Most merchant account providers charge the merchant a monthly fee for access to the merchant services. Monthly fees can vary depending on the service provider. Using your card abroad fee calculator. Rs. Excellent Credit Good Credit Fair Credit Bad Credit Enter Student Loan EMI (if you dont have a student currently, give 0). For example, if you send $100.00 USD from your personal credit card, the fee would be $3.20 USD ($2.90 + $0.30). Standard deposits are free and arrive within 1-3 business days.  Enter your house rent (if you dont have house rent currently, give 0). Business Credit Cards No Foreign Fee Cards No Annual Fee Cards Secured Credit Cards Student Credit Cards Unsecured Cards. If you are buying or selling from $52 to $78.05, the trading fee is $2.99. The interchange rate merchants are charged for debit card transactions is substantially less than those for credit cards. Small Ticket Debit (Less than $15): 1.55% plus $0.04. min. There are several other ways in which credit card issuers calculate the monthly Debit Card : Apply for ATM Cards Online. Jassby Virtual Debit Card. Fees and Charges.

Enter your house rent (if you dont have house rent currently, give 0). Business Credit Cards No Foreign Fee Cards No Annual Fee Cards Secured Credit Cards Student Credit Cards Unsecured Cards. If you are buying or selling from $52 to $78.05, the trading fee is $2.99. The interchange rate merchants are charged for debit card transactions is substantially less than those for credit cards. Small Ticket Debit (Less than $15): 1.55% plus $0.04. min. There are several other ways in which credit card issuers calculate the monthly Debit Card : Apply for ATM Cards Online. Jassby Virtual Debit Card. Fees and Charges.  Great! In other words, the effective rate is how much it costs you to process each credit card sale. 0% fees* when using Convert (crypto-to-crypto and crypto-to-USD). Fees: A flat fee of $10.00 will be applied on top any BTC purchase below $200.

Great! In other words, the effective rate is how much it costs you to process each credit card sale. 0% fees* when using Convert (crypto-to-crypto and crypto-to-USD). Fees: A flat fee of $10.00 will be applied on top any BTC purchase below $200.

dynamic*. Currencies fluctuate every day. Learn about credit cards. $0. Additional 1% fee currency conversion is required. However, you may want to stick with a debit card if:You can't qualify for a credit cardYou want to help a child or young adult develop good spending habitsYou want to avoid any debt, even temporary debt without interest chargesYou struggle to pay off your credit card every month

dynamic*. Currencies fluctuate every day. Learn about credit cards. $0. Additional 1% fee currency conversion is required. However, you may want to stick with a debit card if:You can't qualify for a credit cardYou want to help a child or young adult develop good spending habitsYou want to avoid any debt, even temporary debt without interest chargesYou struggle to pay off your credit card every month

2 or less withdrawals. Enter your monthly gateway fee*. ET, Monday through Friday for assistance by phone.

2 or less withdrawals. Enter your monthly gateway fee*. ET, Monday through Friday for assistance by phone.  Multiply that number by your current balance. Dont forget about the fee. Its usually a percentage of the amount you transfer. For example, a typical PIN debit fee is something like $0.12. There is a daily transaction limit for credit cards of $24,999.99 per credit card per day. Additionally, the current national average 15-year fixed mortgage rate decreased 3 basis points from 4.49% to 4.46%. How to calculate credit card interestConvert your APR to a daily rate The majority of credit card issuers compound interest on a daily basis. Find your average daily balance This step is the most tedious since youll need to know what your balance was every day during the billing cycle. Calculate your interest charges

Multiply that number by your current balance. Dont forget about the fee. Its usually a percentage of the amount you transfer. For example, a typical PIN debit fee is something like $0.12. There is a daily transaction limit for credit cards of $24,999.99 per credit card per day. Additionally, the current national average 15-year fixed mortgage rate decreased 3 basis points from 4.49% to 4.46%. How to calculate credit card interestConvert your APR to a daily rate The majority of credit card issuers compound interest on a daily basis. Find your average daily balance This step is the most tedious since youll need to know what your balance was every day during the billing cycle. Calculate your interest charges  The Jassby Virtual Debit Card for kids stands apart since it has no monthly fee and a very user-friendly app. Most balance transfer cards charge a fee when you transfer your debt. Share sensitive information only on official, secure websites. Some of the fees to consider include: Ordering a Wise debit card: 5 GBP; Getting a replacement card: 3GBP ATM withdrawals over 200 per month: 1.75%; Over 2 ATM 1.20% on balances of $0 to $50,000. If youre a business with a large transaction volume or unique business model, reach out to discuss custom FEES & CHARGES. The Rewards+ Debit Card fees and charges include annual fees, my design charges, replacement charges as well as an issuance fee. Enter your monthly statement fee*. Our calculator displays your monthly income and debts you need to pay, along with the Debt to Burden Ratio. 3.99/3.99/$3.99 or currency equivalent. Travel Cards. Dividends are earned daily at the dividend rate and APY corresponding to the account balance each day. Rates can change weekly after the Money Market Account is opened. Low Borrowing Costs. Help & Contact Questions and Applications 1-888-KEY-0018. Use our Square Payments Fee Calculator to accurately understand our processing fees. If you are buying or selling between $11 and 26.49, the trading fee is $1.49. Why We Chose It. 6. Standard rates apply for ACH, swiped, invoiced, and keyed card transactions. Find your fee in one of three ways: the Fee Calculator, the Fee Chart PDF, or the Fee Charts below. dynamic*. 50 along with an annual usage charge of Rs.

The Jassby Virtual Debit Card for kids stands apart since it has no monthly fee and a very user-friendly app. Most balance transfer cards charge a fee when you transfer your debt. Share sensitive information only on official, secure websites. Some of the fees to consider include: Ordering a Wise debit card: 5 GBP; Getting a replacement card: 3GBP ATM withdrawals over 200 per month: 1.75%; Over 2 ATM 1.20% on balances of $0 to $50,000. If youre a business with a large transaction volume or unique business model, reach out to discuss custom FEES & CHARGES. The Rewards+ Debit Card fees and charges include annual fees, my design charges, replacement charges as well as an issuance fee. Enter your monthly statement fee*. Our calculator displays your monthly income and debts you need to pay, along with the Debt to Burden Ratio. 3.99/3.99/$3.99 or currency equivalent. Travel Cards. Dividends are earned daily at the dividend rate and APY corresponding to the account balance each day. Rates can change weekly after the Money Market Account is opened. Low Borrowing Costs. Help & Contact Questions and Applications 1-888-KEY-0018. Use our Square Payments Fee Calculator to accurately understand our processing fees. If you are buying or selling between $11 and 26.49, the trading fee is $1.49. Why We Chose It. 6. Standard rates apply for ACH, swiped, invoiced, and keyed card transactions. Find your fee in one of three ways: the Fee Calculator, the Fee Chart PDF, or the Fee Charts below. dynamic*. 50 along with an annual usage charge of Rs.  ELIGIBILITY. Your monthly payment amount: Our balance transfer calculator will show the cost and time to pay off debt Add-on Debit Card - Gold Card / Platinum. 1. Debit card is popularly known as easily accessible plastic cash, which offers electronic access to your savings account in any bank via ATM machines or card swipes. Yes, Binance US charges a fee, however, it is the lowest fee charged with 0.02% to 0.10% as purchase and trading fees and 3% When using a credit card or all Key2Benefits Schedule of Card Fees You agree to pay the fees disclosed in this Schedule of Card Fees (Schedule of Fees).

ELIGIBILITY. Your monthly payment amount: Our balance transfer calculator will show the cost and time to pay off debt Add-on Debit Card - Gold Card / Platinum. 1. Debit card is popularly known as easily accessible plastic cash, which offers electronic access to your savings account in any bank via ATM machines or card swipes. Yes, Binance US charges a fee, however, it is the lowest fee charged with 0.02% to 0.10% as purchase and trading fees and 3% When using a credit card or all Key2Benefits Schedule of Card Fees You agree to pay the fees disclosed in this Schedule of Card Fees (Schedule of Fees).  By switching to a 0% balance transfer card for 24 months and a one-off fee of 1.4%, you would pay your card off by January 0 and pay a total of -1,915 in fees and interest.

By switching to a 0% balance transfer card for 24 months and a one-off fee of 1.4%, you would pay your card off by January 0 and pay a total of -1,915 in fees and interest.  Funds transfer to a personal The rate shown is effective for transactions submitted to Visa on , with a bank foreign transaction fee of %. The Cash App instant transfer fee is 1.5%, with a minimum of $0.25. $1,792. Debit card fees can vary broadly depending on the debit card used, your merchant category, and whether a PIN is used during the transaction. We will reject your application, petition, or request if the card is declined, and we will not attempt to process your credit card payment a second time. Enter your processing rate*. Also, Visa offers discount offers for many a maximum of $4.99 USD. The Citi Diamond Preferred Card offers an introductory 0% APR on balance transfers for 21 months, then 14.49% - 24.49% variable APR. Up to 5% CashBack on select categories. * We charge a dynamic network fee on all BTC, ETH and ERC20 tokens purchases. Automatically borrow against your account at USD 3.08% or less 1, which is lower than credit cards, personal loans or home equity lines of credit, without monthly minimum payments or late fees. Funded by a credit card, debit card or PayPal Credit. No Charge. BusyKid costs $3.99 per month or $38.99 per year for up to five cards. Below is a list of the average range of fees of the 4 major credit card companies: Visa: 1.4-2.5%. Convenience Fee Calculator. For NatWest debit cards, it starts on 25th June at 00:00 local time and ends on 2nd September at 23.59 local time. Locate your balance and current APR on your credit card statement. DOCUMENTATION. Enter your monthly statement fee*. Issuance Fees. When sending money from the U.S., it costs 2.9% plus $0.30 USD of the amount youre sending. Enter only the fees paid on Mastercard debit cards, not processing volume. For those of you who skipped down to this section, well go over PayPals payment fees one more time. When you use your debit, credit or cash card abroad to make a purchase or a withdrawal from a cash machine, you may be offered the option to pay in local currency or pounds sterling. Deposits Terms and Conditions. 0% APR Cards.

Funds transfer to a personal The rate shown is effective for transactions submitted to Visa on , with a bank foreign transaction fee of %. The Cash App instant transfer fee is 1.5%, with a minimum of $0.25. $1,792. Debit card fees can vary broadly depending on the debit card used, your merchant category, and whether a PIN is used during the transaction. We will reject your application, petition, or request if the card is declined, and we will not attempt to process your credit card payment a second time. Enter your processing rate*. Also, Visa offers discount offers for many a maximum of $4.99 USD. The Citi Diamond Preferred Card offers an introductory 0% APR on balance transfers for 21 months, then 14.49% - 24.49% variable APR. Up to 5% CashBack on select categories. * We charge a dynamic network fee on all BTC, ETH and ERC20 tokens purchases. Automatically borrow against your account at USD 3.08% or less 1, which is lower than credit cards, personal loans or home equity lines of credit, without monthly minimum payments or late fees. Funded by a credit card, debit card or PayPal Credit. No Charge. BusyKid costs $3.99 per month or $38.99 per year for up to five cards. Below is a list of the average range of fees of the 4 major credit card companies: Visa: 1.4-2.5%. Convenience Fee Calculator. For NatWest debit cards, it starts on 25th June at 00:00 local time and ends on 2nd September at 23.59 local time. Locate your balance and current APR on your credit card statement. DOCUMENTATION. Enter your monthly statement fee*. Issuance Fees. When sending money from the U.S., it costs 2.9% plus $0.30 USD of the amount youre sending. Enter only the fees paid on Mastercard debit cards, not processing volume. For those of you who skipped down to this section, well go over PayPals payment fees one more time. When you use your debit, credit or cash card abroad to make a purchase or a withdrawal from a cash machine, you may be offered the option to pay in local currency or pounds sterling. Deposits Terms and Conditions. 0% APR Cards.  These averages are for both signature and PIN transactions. For the calculations, we have Additional fees required for international cards and currency conversion. This calculator factors in a balance, interest rate (APR) and monthly payment amount to estimate a payoff period and the total interest paid. According to data from 2018, the average interchange fee was $0.23. Enter Your Statements Visa Credit Card Fees. Instant Deposits are subject to a 0.5% -1.75% fee (with a minimum fee of $0.25) and arrive instantly to your debit card. Shop online or offline, withdraw cash from ATMs, pay your bills and earn rewards in the process. Cash App offers standard deposits to your bank account and Instant Deposits to your linked debit card. Payment method. Visa - Rewards+. EDD Debit Card Fee Disclosures Monthly Fee Per purchase ATM withdrawal $0 in-network $1.00 Cash reload $0$0 **out-of-network N/A ATM balance inquiry $0 Customer service $0 per call Inactivity $0 We charge 5 other types of fees. 0% fees* when using OTC (Over-the-Counter) Portal. The Federal Reserve reported Home Lending Customer Service 1-800-422-2442. Visa Debit Interchange Fees. * The Payoneer Commercial Mastercard program offers 2 types of card services. Note: Payoff timeframes assume the average APR among credit card accounts with finance charges: 16.43%. $125 - $175 USD 36. BTC rate: Simplex sets the rate at which USD to BTC is converted, not Abra. If you want to do it yourself, the formula is: (total processing fees / total sales volume) x 100. Credit Cards Calculators.

These averages are for both signature and PIN transactions. For the calculations, we have Additional fees required for international cards and currency conversion. This calculator factors in a balance, interest rate (APR) and monthly payment amount to estimate a payoff period and the total interest paid. According to data from 2018, the average interchange fee was $0.23. Enter Your Statements Visa Credit Card Fees. Instant Deposits are subject to a 0.5% -1.75% fee (with a minimum fee of $0.25) and arrive instantly to your debit card. Shop online or offline, withdraw cash from ATMs, pay your bills and earn rewards in the process. Cash App offers standard deposits to your bank account and Instant Deposits to your linked debit card. Payment method. Visa - Rewards+. EDD Debit Card Fee Disclosures Monthly Fee Per purchase ATM withdrawal $0 in-network $1.00 Cash reload $0$0 **out-of-network N/A ATM balance inquiry $0 Customer service $0 per call Inactivity $0 We charge 5 other types of fees. 0% fees* when using OTC (Over-the-Counter) Portal. The Federal Reserve reported Home Lending Customer Service 1-800-422-2442. Visa Debit Interchange Fees. * The Payoneer Commercial Mastercard program offers 2 types of card services. Note: Payoff timeframes assume the average APR among credit card accounts with finance charges: 16.43%. $125 - $175 USD 36. BTC rate: Simplex sets the rate at which USD to BTC is converted, not Abra. If you want to do it yourself, the formula is: (total processing fees / total sales volume) x 100. Credit Cards Calculators.  You

You  By selecting "Credit" and signing for purchases, you are protected from unauthorized use with Visa Zero Liability 1 - even if you're using your debit card. Online bill payment. Phone assistance in Spanish at 844-4TRUIST (844-487-8478), option 9. Credit Score. A free account for crypto and cash that earns a 1.2% bonus rate plus 5% cashback on purchases from participating retailers. Learn More. *Exclusive of taxes.

By selecting "Credit" and signing for purchases, you are protected from unauthorized use with Visa Zero Liability 1 - even if you're using your debit card. Online bill payment. Phone assistance in Spanish at 844-4TRUIST (844-487-8478), option 9. Credit Score. A free account for crypto and cash that earns a 1.2% bonus rate plus 5% cashback on purchases from participating retailers. Learn More. *Exclusive of taxes.  3.99/3.99/$3.99 or currency equivalent. Divide your APR by 12 (for the 12 months of the year): 16.99% / 12 = about 1.42%. 2% 2.5% 3%. Replacement card. There are no fees when you select CREDIT for signature-based purchases. Square is PCI compliant so your business can safely and securely process debit and credit card transactions. Best Overall : Greenlight. Description. Choose from our range of debit cards to experience the advantage of quick and easy payments. Minimum repayment ($): If your calculated minimum No funding fee. $0. $15.00 per card. From 0.41%.

3.99/3.99/$3.99 or currency equivalent. Divide your APR by 12 (for the 12 months of the year): 16.99% / 12 = about 1.42%. 2% 2.5% 3%. Replacement card. There are no fees when you select CREDIT for signature-based purchases. Square is PCI compliant so your business can safely and securely process debit and credit card transactions. Best Overall : Greenlight. Description. Choose from our range of debit cards to experience the advantage of quick and easy payments. Minimum repayment ($): If your calculated minimum No funding fee. $0. $15.00 per card. From 0.41%.  Using this simple calculator, find out how much your credit card provider charges you for purchases made in different Different issuers charge different rates, but the fee usually lands around 3%-5% of your bank transfers. Enter your monthly minimum fee*. Below shows the calculated exchange rate. Check your credit card statement. $0. Enter your monthly gateway fee*. You can request a debit or ATM card during the account opening process. Cash App Support Cash Out Speed Options. The minimum monthly repayment is usually a percentage of the closing balance. + 0.50 GBP per withdrawal.

Using this simple calculator, find out how much your credit card provider charges you for purchases made in different Different issuers charge different rates, but the fee usually lands around 3%-5% of your bank transfers. Enter your monthly minimum fee*. Below shows the calculated exchange rate. Check your credit card statement. $0. Enter your monthly gateway fee*. You can request a debit or ATM card during the account opening process. Cash App Support Cash Out Speed Options. The minimum monthly repayment is usually a percentage of the closing balance. + 0.50 GBP per withdrawal.

If you prefer, you can give us a call at 1.800.975.4722 Monday through Sunday 7am 12am ET. Dynamic Tax Limit for tax payments of up to 50 lacs. Our Credit Card Payoff Calculator assumes the The current average 30-year fixed mortgage rate fell 3 basis points from 5.37% to 5.34% on Saturday, Zillow announced. Discover: 1.55-2.5%.

If you prefer, you can give us a call at 1.800.975.4722 Monday through Sunday 7am 12am ET. Dynamic Tax Limit for tax payments of up to 50 lacs. Our Credit Card Payoff Calculator assumes the The current average 30-year fixed mortgage rate fell 3 basis points from 5.37% to 5.34% on Saturday, Zillow announced. Discover: 1.55-2.5%.  Use this calculator to find out how many month you may need to pay off your credit card debt. View details. If you have already opened your consumer deposit account (s) with HSBC, you can chat with us now to order a card. Rates can change weekly after the Money Market Account is opened.

Use this calculator to find out how many month you may need to pay off your credit card debt. View details. If you have already opened your consumer deposit account (s) with HSBC, you can chat with us now to order a card. Rates can change weekly after the Money Market Account is opened.  A free account for crypto Payment can be made online with a credit/debit card via ePayment. You also agree that we may deduct these fees and any other Heres why. For example, a standard Visa rewards credit card has an interchange fee of 1.65% + 10, while a Visa debit card is 0.05% + 22. The above fees will be waived as long as you are a part of the HDFC Bank Imperia Premium Banking Programme. PCI compliance. Free. Your estimated total monthly MasterCard Titanium Prime. 50. The 30-year fixed mortgage rate on July 16, 2022 is equal to the previous week's average rate of 5.34%. 5% of the send amount with. International payments. As a quick example, if Enclosed below are HDFC Bank EasyShop Imperia Platinum Chip Debit Card Interest Rates & Charges. The BusyPay QR code makes it easy for family and friends to send your child cash gifts. For example, if it costs you $450 to process $15,000 worth of card sales, then your effective processing rate is 3%. Card Platform. https://www.bankalfalah.com/eligibility-calculator-for-debit-cards $3.99) min. 9 years and 6 months. In Cards for Bad Credit. Are there any fees for using my chip-enabled debit card?

A free account for crypto Payment can be made online with a credit/debit card via ePayment. You also agree that we may deduct these fees and any other Heres why. For example, a standard Visa rewards credit card has an interchange fee of 1.65% + 10, while a Visa debit card is 0.05% + 22. The above fees will be waived as long as you are a part of the HDFC Bank Imperia Premium Banking Programme. PCI compliance. Free. Your estimated total monthly MasterCard Titanium Prime. 50. The 30-year fixed mortgage rate on July 16, 2022 is equal to the previous week's average rate of 5.34%. 5% of the send amount with. International payments. As a quick example, if Enclosed below are HDFC Bank EasyShop Imperia Platinum Chip Debit Card Interest Rates & Charges. The BusyPay QR code makes it easy for family and friends to send your child cash gifts. For example, if it costs you $450 to process $15,000 worth of card sales, then your effective processing rate is 3%. Card Platform. https://www.bankalfalah.com/eligibility-calculator-for-debit-cards $3.99) min. 9 years and 6 months. In Cards for Bad Credit. Are there any fees for using my chip-enabled debit card?  But most can only get it from November and you could earn up to 130 switching bank account NOW, so is Chase worth it? This gives us a total charge of 0.95% plus a $0.25 transaction fee. There is a fee-free offer on this summer so the results in this table may not be accurate. No Fee Cards. A few key notes when purchasing BTC with Simplex. $157.25 $220.15 CAD 35.

But most can only get it from November and you could earn up to 130 switching bank account NOW, so is Chase worth it? This gives us a total charge of 0.95% plus a $0.25 transaction fee. There is a fee-free offer on this summer so the results in this table may not be accurate. No Fee Cards. A few key notes when purchasing BTC with Simplex. $157.25 $220.15 CAD 35.

Astonishingly, the card charges no monthly fee and no pay-as-you-go fee. Instant Deposit is an additional service offered by QuickBooks Payments subject to eligibility criteria. A balance transfer can help you save money by moving high-interest debt on one credit card to a card with a lower interest rate or an introductory 0% APR offer. International Service Assessment. Step 3: Enter your new card details. it's important to do your Monthly Credit Card Volume. Getting the Wise How to calculate interest based on a monthly periodic rate method. 1%. In the case of PIN debit, a processor only applies a single transaction-based markup to the transaction.

Astonishingly, the card charges no monthly fee and no pay-as-you-go fee. Instant Deposit is an additional service offered by QuickBooks Payments subject to eligibility criteria. A balance transfer can help you save money by moving high-interest debt on one credit card to a card with a lower interest rate or an introductory 0% APR offer. International Service Assessment. Step 3: Enter your new card details. it's important to do your Monthly Credit Card Volume. Getting the Wise How to calculate interest based on a monthly periodic rate method. 1%. In the case of PIN debit, a processor only applies a single transaction-based markup to the transaction.  $1,961. In addition, you can use the Debit Mastercard at The free Square card reader works with the free Square POS app so you can accept payments on your smartphone or tablet. Dividends are credited and compounded monthly. 1.20% on balances of $0 to $50,000.

$1,961. In addition, you can use the Debit Mastercard at The free Square card reader works with the free Square POS app so you can accept payments on your smartphone or tablet. Dividends are credited and compounded monthly. 1.20% on balances of $0 to $50,000.  Terms and Conditions. Rs.750 per year (plus taxes as applicable) Add-on Debit Card - Times Points. To determine the final cost, add the processors markup to the fees the PIN debit network charges. $0. Secured Cards. Go to site. Spending Limit: $1,000 per day. Moreover, the card doesnt charge an activation fee or a card fee when you buy the card online. 2.9% of the transaction amount funded this way plus a fixed fee based on currency (from the table here ). 1% + 30 for cross-border transactions. Annual fee per EasyShop Imperia Platinum Chip Debit Card is Rs. Enter your transaction fee*. Issuance Fess - Primary/Joint. Who wants to haggle over rates? As a percentage of a purchase, the average interchange fee was 0.57%. This debt payoff calculator can help give you a sense of timing and monthly payments as you put together a repayment plan, but it doesnt consider other factors such as your cards annual Overview. 0.25% on balances of $50,000.01+. Greenlight offers low fees, a free trial, an easy-to-use app, and built-in allowance and chore features, making it our choice as the best overall debit card for teens. a minimum of $0.99 USD. This is due to a number of factors, chief of which is that debit cards are less of a risk. Retail Debit ($15 or more): 0.80% plus $0.15. Credit cards with promotional financing offers are a fantastic way to avoid interest charges, but nearly all will add a 3 percent Enter only the fees paid on Visa credit cards, not A locked padlock ) or https:// means you've safely connected to the .gov website. to. 24 September 2021. For detailed information related to the Rewards+ Debit Card fees and charges, please refer to the information below. Foreign Transaction Fees. In-Person tooltip. Carry your bank account in the comfort of your wallet with debit cards from ICICI Bank. Parental Controls: Yes. Debt-to-income ratio (DTI) is the ratio of total debt payments divided by gross income (before tax) expressed as a percentage, usually on either a monthly or annual basis.

Terms and Conditions. Rs.750 per year (plus taxes as applicable) Add-on Debit Card - Times Points. To determine the final cost, add the processors markup to the fees the PIN debit network charges. $0. Secured Cards. Go to site. Spending Limit: $1,000 per day. Moreover, the card doesnt charge an activation fee or a card fee when you buy the card online. 2.9% of the transaction amount funded this way plus a fixed fee based on currency (from the table here ). 1% + 30 for cross-border transactions. Annual fee per EasyShop Imperia Platinum Chip Debit Card is Rs. Enter your transaction fee*. Issuance Fess - Primary/Joint. Who wants to haggle over rates? As a percentage of a purchase, the average interchange fee was 0.57%. This debt payoff calculator can help give you a sense of timing and monthly payments as you put together a repayment plan, but it doesnt consider other factors such as your cards annual Overview. 0.25% on balances of $50,000.01+. Greenlight offers low fees, a free trial, an easy-to-use app, and built-in allowance and chore features, making it our choice as the best overall debit card for teens. a minimum of $0.99 USD. This is due to a number of factors, chief of which is that debit cards are less of a risk. Retail Debit ($15 or more): 0.80% plus $0.15. Credit cards with promotional financing offers are a fantastic way to avoid interest charges, but nearly all will add a 3 percent Enter only the fees paid on Visa credit cards, not A locked padlock ) or https:// means you've safely connected to the .gov website. to. 24 September 2021. For detailed information related to the Rewards+ Debit Card fees and charges, please refer to the information below. Foreign Transaction Fees. In-Person tooltip. Carry your bank account in the comfort of your wallet with debit cards from ICICI Bank. Parental Controls: Yes. Debt-to-income ratio (DTI) is the ratio of total debt payments divided by gross income (before tax) expressed as a percentage, usually on either a monthly or annual basis.  For example, those rules only apply to banks and credit unions with $10 billion or more in assets. Total Savings. Fees: $4.99 to $9.98 per month. If you select DEBIT, or the merchant routes the transaction as DEBIT, a fee may be assessed regardless of whether a PIN was entered. Fee. Encourage debit card payments Debit cards have much lower interchange rates. When you shift The algorithm of this finance charge calculator uses the standard equations explained: Finance charge [A] = CBO * APR * 0.01 * VBC/BCL. $15.00.

For example, those rules only apply to banks and credit unions with $10 billion or more in assets. Total Savings. Fees: $4.99 to $9.98 per month. If you select DEBIT, or the merchant routes the transaction as DEBIT, a fee may be assessed regardless of whether a PIN was entered. Fee. Encourage debit card payments Debit cards have much lower interchange rates. When you shift The algorithm of this finance charge calculator uses the standard equations explained: Finance charge [A] = CBO * APR * 0.01 * VBC/BCL. $15.00.  Binance.US collects a small spread margin between the buy and sell price of an asset. Credit Card Loan Payoff. The more you process, the more you save. 0.5% fees on buy and sell orders placed on the Buy Crypto page *Prices quoted are based on market conditions. Make sure the card has enough money to cover the fee at the time of filing. Credit Card Charges Calculator. The average interchange fee varies among the different card brands that most consumers use. 8 years and 11 months.

Binance.US collects a small spread margin between the buy and sell price of an asset. Credit Card Loan Payoff. The more you process, the more you save. 0.5% fees on buy and sell orders placed on the Buy Crypto page *Prices quoted are based on market conditions. Make sure the card has enough money to cover the fee at the time of filing. Credit Card Charges Calculator. The average interchange fee varies among the different card brands that most consumers use. 8 years and 11 months.  Click Calculate. Free. This New balance you owe [B] = CBO + [A] Where: CBO = American Express: 1.80% to 3.25%.

Click Calculate. Free. This New balance you owe [B] = CBO + [A] Where: CBO = American Express: 1.80% to 3.25%.  Clients using a TDD/TTY device: 1-800-539-8336 Debit Card. For For NatWest credit cards, the offer starts on 24th June at 00:00 local time and ends on 2nd September 2022 at 23.59 local time. However, other card issuers can charge more.

Clients using a TDD/TTY device: 1-800-539-8336 Debit Card. For For NatWest credit cards, the offer starts on 24th June at 00:00 local time and ends on 2nd September 2022 at 23.59 local time. However, other card issuers can charge more.  Overnight delivery of replacement card. Enter Your Statements Visa Credit Card Fees. Enter only the fees paid on Mastercard debit cards, not processing volume. It has You can also earn 1 RBC Rewards point for every $1 you spend 6 with the Visa Signature Black card. Rs. No Annual Fee; No Foreign Transaction Fees; Card Type. 1.75%. Foreign transaction fee: Sometimes called a currency conversion fee, this applies for foreign transactions made with a debit card. 1% + 0.30 for non-European transactions. The "currency calculator" below gives you an indication of the cost of purchases you make when traveling internationally. SmartAsset's credit card calculator allows you to add your credit card debt details to calculate the total interest and time it will take for you to pay off your debt. No trading fees apply to the Convert & OTC features. Credit Card Charges Calculator. Fee Type. More than 85,000 ATMs nationwide. If you are buying or selling from $26.50 to $51.99, the trading fee is $1.99.

Overnight delivery of replacement card. Enter Your Statements Visa Credit Card Fees. Enter only the fees paid on Mastercard debit cards, not processing volume. It has You can also earn 1 RBC Rewards point for every $1 you spend 6 with the Visa Signature Black card. Rs. No Annual Fee; No Foreign Transaction Fees; Card Type. 1.75%. Foreign transaction fee: Sometimes called a currency conversion fee, this applies for foreign transactions made with a debit card. 1% + 0.30 for non-European transactions. The "currency calculator" below gives you an indication of the cost of purchases you make when traveling internationally. SmartAsset's credit card calculator allows you to add your credit card debt details to calculate the total interest and time it will take for you to pay off your debt. No trading fees apply to the Convert & OTC features. Credit Card Charges Calculator. Fee Type. More than 85,000 ATMs nationwide. If you are buying or selling from $26.50 to $51.99, the trading fee is $1.99.  Finder Rating: 4.8 / 5: .

Finder Rating: 4.8 / 5: .  Spending with your card. On a $25 purchase, a debit card will cost you $0.23, compared to $0.51 for credit cards. Add-on Debit Card - Titanium. Best with No ATM Fees: American Express Serve. Best with No Foreign Transaction Fees: Bluebird by American Express. Dont let the short list fool you, though. These arent the only prepaid debit cards on the market that can help you avoid the stink of fees. For example, let's say your balance is $1,000 and your APR is 16.99%. 250 per year (plus taxes as applicable) Add-on Debit Card - Titanium Royale. Zero Liability Cover of up to 5 lacs on fraudulent POS transactions. Withdrawing 200 GBP per month. Already for some time is valid EU regulation setting interchange fee maximum levels Credit and debit cards are not accepted. Mastercard: 1.5-2.6%. Cash Back Cards. Expedite receiving a replacement card. A debit card spending maximum is set by the individual bank or credit union that issues the debit card. Now that Personal Credit Cards; Business Credit Cards; Student Credit Cards; Secured Credit Cards; Prepaid & Debit Cards; The minimum deposit required to open the account and avoid a low balance fee is $2,500. tooltip. More than 85,000 ATMs nationwide. Cards for Fair Credit. Finding ideal credit card; 5 tips if you're tempted by a 0% credit card; How to avoid late fees;

Spending with your card. On a $25 purchase, a debit card will cost you $0.23, compared to $0.51 for credit cards. Add-on Debit Card - Titanium. Best with No ATM Fees: American Express Serve. Best with No Foreign Transaction Fees: Bluebird by American Express. Dont let the short list fool you, though. These arent the only prepaid debit cards on the market that can help you avoid the stink of fees. For example, let's say your balance is $1,000 and your APR is 16.99%. 250 per year (plus taxes as applicable) Add-on Debit Card - Titanium Royale. Zero Liability Cover of up to 5 lacs on fraudulent POS transactions. Withdrawing 200 GBP per month. Already for some time is valid EU regulation setting interchange fee maximum levels Credit and debit cards are not accepted. Mastercard: 1.5-2.6%. Cash Back Cards. Expedite receiving a replacement card. A debit card spending maximum is set by the individual bank or credit union that issues the debit card. Now that Personal Credit Cards; Business Credit Cards; Student Credit Cards; Secured Credit Cards; Prepaid & Debit Cards; The minimum deposit required to open the account and avoid a low balance fee is $2,500. tooltip. More than 85,000 ATMs nationwide. Cards for Fair Credit. Finding ideal credit card; 5 tips if you're tempted by a 0% credit card; How to avoid late fees;  750* p.a. Top 3 features on the card. Payoneer will not apply a per-transaction fee for purchases made in USD using the Payoneer Digital Check your eligibility. Fee assessed for purchases made in a foreign currency (in person or online) Fee. Fee. 150. If youre a business with a large transaction volume or unique business model, reach out to discuss custom economics and interchange revenue sharing. The fee for sending domestic transactions applies plus the additional percentage-based fee for international transactions (international fee). We automatically lower your rates as your business processes more. Finder Rating: 4.8 / 5: . PayPal (MasterCard Enter your monthly minimum fee*. What services does ReliaCard Getting your unemployment benefits on the ReliaCard1. Purchasable amount: You can purchase $50-$20,000 of BTC. MasterCard Debit Interchange Fees. Do not cancel your check or money order after you The fees can be paid by cash, check, money order or credit/debit card.The court will not accept out of state checks. When using a consumer/personal debit card, a flat convenience fee of $2.50 is charged by Pay1040.com for using this service. Enter your transaction fee*. Enter your credit card limit (if you dont own a credit card, give 0). 650 per year (plus taxes as applicable) Add-on Debit Card - Women's Card. 2 There are no monthly minimum payments or late fees, so you have the flexibility to pay back loans at your own pace. 300.